Dave Ramsey budget forms – When you’re overwhelmed with debt, it’s hard to know where to turn or how to find resources that will help you the most.

Maybe you’ve heard Dave Ramsey talk about money on the radio, listened to his podcast, or even read one of his books. But how can you find all the right Dave Ramsey budget forms for getting started? There are so many great forms to choose from!

Below you’ll find a short list of free Dave Ramsey budget forms that will be the most helpful to you as you’re getting started. I tried to keep this list simple, with the basic budget forms you might need to get started. If you want more options, click here for my longer list with tons of pretty Dave Ramsey printables.

Be sure to read our debt free story: We’re Debt Free! Our Story Of How We Paid Off Our House

Now, without further ado… here are some of the most important forms to get you started.

UPDATE MAY 2019: I have a new post up with 21 more “inspired by” Dave Ramsey budgeting printables.

Dave Ramsey Budget Forms

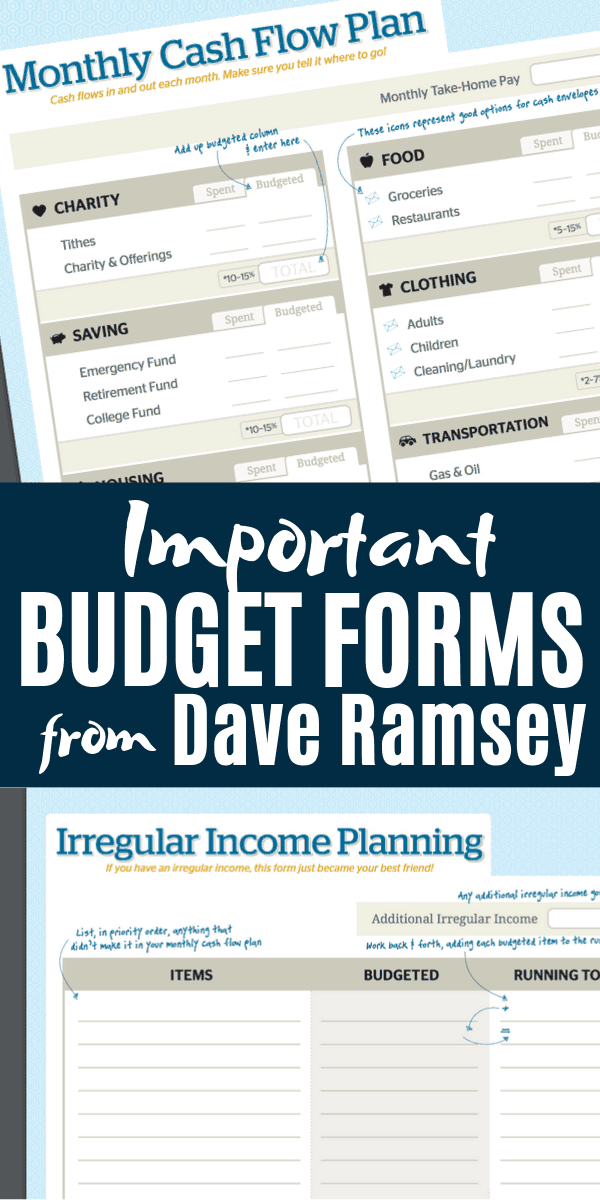

Monthly Cash Flow Budget Form

Use this Monthly Cash Flow form to organize everything you need to pay and your debt minimum payments. Next to everything write the due date.

Spending Plan Budget Form

Then, use this Spending Plan form to create your budget. You need a column PER PAYDAY which will change every month. If you’re paid weekly or bi-weekly, some months will have more than four pay columns.

Like Dave says, you’ve got to tell your money what to do or it will leave. Be diligent about using these budgeting forms, and know where your money is going — every penny of it!

Variable Income Budget Form

If you get paid a variable income rather than a set amount each payday, it can be somewhat confusing to get started. Dave has this Irregular Income form to help you plan for each income source.

As you’re setting up your budget, you may find that you need to call certain utilities, creditors, or other billing companies and request to change billing cycles. Usually there’s no problem when you try to tweak your “due by” dates, within reason. Don’t be intimidated! Many companies are happy to help if they feel it will help them receive your payments in a timely manner.

List of Useful Dave Ramsey Forms

Dave also has an area on his site that lists many of his available budget forms (on the Useful Forms page). It includes the monthly cash flow sheet, consumer equity sheet, lump sum payment planning, and more. They are all printable budget forms. Bookmark the page — it’s nice to keep it handy!

But What If You Can’t Pay Your Bills?

If you’re pretty far behind with your bills and can’t seem to get current, here are helpful tips from Dave about what to do when you can’t pay your bills.

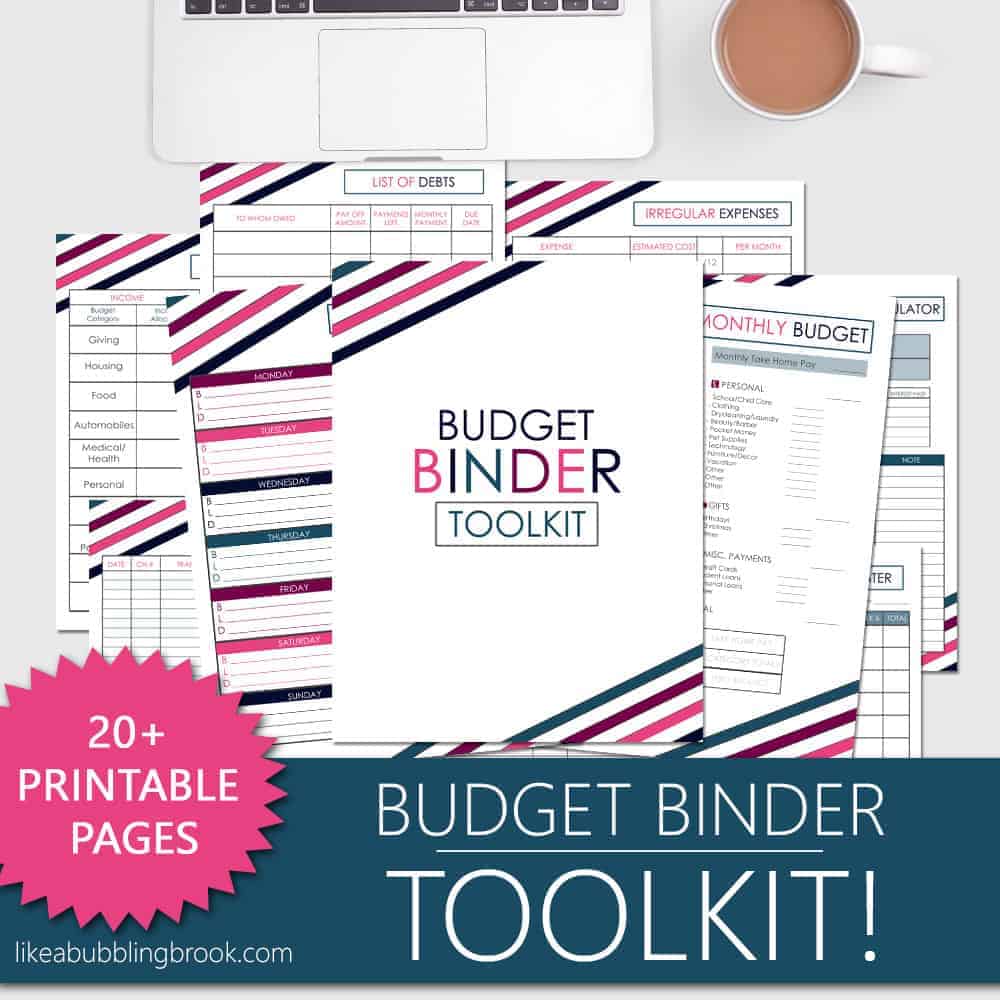

Our Budget Toolkit Printables

I also designed a beautiful Budget Binder Toolkit that has really helpful budgeting forms, plus all the printables are easy to use. It’s easy to print them, fill them out, and put them in a three pronged binder. Everything you need is there in one easy PDF file. There’s even a “spending journal” printable! You can learn more about the Budget Binder Toolkit here.

You can do this! One step at a time, my friend. Just keep putting one foot in front of the other, and you’ll get there. It’s worth it!

Before you go, take a minute and tell us about some Dave Ramsey Budget Forms that have been helpful to you. We’d love to know.

You might also like:

- The Best Dave Ramsey YouTube Videos

- 13 Things Dave Ramsey Fans Wish You Knew

- Our Dave Ramsey Meal Plan For A Beans + Rice Budget

- The 7 Dave Ramsey Baby Steps To Financial Freedom

Go in grace today,

P.S. New to my web site? I like to write about ways to optimize your life, save money, and cook cheap meals at home! Here are a few more ways you can save money:

- Cook at home more often. We used to waste so much money going out to eat! This is a constant struggle for us as a busy family. Try a program like emeals (the link takes to you a free 14-day trial) to help you create simple, inexpensive meals at home if you struggle in this area like I do. You’ll save MORE money on your groceries each month than the small amount you pay for their service.

- Earn Amazon gift cards. A simple way to earn a little extra money from home by using the Swagbucks site instead of Google for searching. You can also do surveys and a few other things to earn points, which you redeem to purchase gift cards from them. Swagbucks is what we used to earn Amazon gift cards and pay for Christmas gifts one year. (Click here to read about how we did it.)

- Create a budget. Mvelopes is the online budgeting program we personally use and LOVE. In fact, we purchased a lifetime membership several years ago when they offered it to us. It’s like a virtual cash envelope system, and it syncs with your bank accounts. Here’s my full Mvelopes review, or you can click here for a free 30 day trial of Mvelopes.

Pin this for later:

Jaime,

My husband and I took a FP course years ago, but we never fully followed the plan. We’re not doing well again and I was looking around online, wishing I had access to the FP stuff now, just quickly, not the whole book to go through. Then today I saw your request to join my group boards and I immediately saw this post! How awesome is our God?! Something that others might think is insignificant is actually Him working in our lives.

Thanks for sharing these.

God bless,

Jenn

If you have previously taken the course, you can contact over of the local group’s leaders and all about getting one for a discounted rate since you already took the course. I was able to get the new course for only $50 and took it all over again just as a refresher.

Thank you Jaime for sharing these and the helpful information,

Kevin

My husband and I were forced to leave our orginal house we bought it for 109k and we were there 13 years and the village told us they were buying 9 house in the city in Denmark wis to build a business park. So that was last year and our home was worth 108k and the city gave us 225k for a 2 bedroom brick home with. 55 acres in the back yard. But we paid off our home first 73k and we were approved to buy 3 bedroom 3 car garage and 30×40 pole barn for 204k and we put down 43k and we paid off all of our debts and we owe 159k our payments are 1176 a month. We have very small debts to pay off. We just need a little help with your budget forms I’ll have to order them to keep on track. Were on medical leave until October with our company we drive for covenant transport we are truck drivers. Who want to contribute to our 401k or Roth IRA account. I’m 62 years of age and my husband is 58 we want to continue driving after our medical leave continue working with covenant transport from Chattanooga Tennessee. For another 3 more years and then work at home. Just need to get on the right track. With your help I’m hoping.