If you’ve followed Dave Ramsey’s baby steps, then you know how crucial cash is in the first few steps. Dave is a HUGE advocate for the Cash Envelope System for budgeting. There are many reasons why, and we’ll talk about a few of them here. We’ll also talk about how to get started and use your cash envelopes.

Let’s begin!

Cash Envelope System: What Is It?

Maybe your family income is $800 a week, and you budget $125/week for your groceries. When your paycheck is direct deposited each week, you go to the bank and withdraw $125, put that cash in an envelope and label it “groceries”.

Here’s the hard part… The ABSOLUTE, ONLY thing you can spend that cash on is on – GASP! – groceries. You have to practice discipline here! Don’t compromise. If you’re at the checkout counter, and your bill comes to $128.27, guess what? Something needs to be put back. You only have $125 to spend. Remember, it’s the little foxes that spoil the vine. Pennies turn in to dollars. It ALL matters!

Cash Envelope System: Why?

So, why are we going through all this trouble? Can’t you just use your debit card instead of cash? NO. There’s psychology behind this. You can read all about it at Psychology Today and also at Consumer Reports: “In one study at Massachusetts Institute of Technology, researchers asked business students to bid on Boston Celtics basketball tickets, telling some they’d eventually have to pay with cash and others they’d need to use a card. The average bid for those expecting to pay by card was $60, more than twice the average bid from those primed to pay with cash.”

It’s a proven fact that people tend to spend more money when they pay with plastic instead of cash.

Cash Envelope System: How To Get Started

Typically, you should plan for your fixed expenses (like your rent/mortgage, your utility bill, etc) to come out of your checking account. Other budget items that tend to be more variable are set up with the cash envelope system (like groceries, eating out, gas, etc).

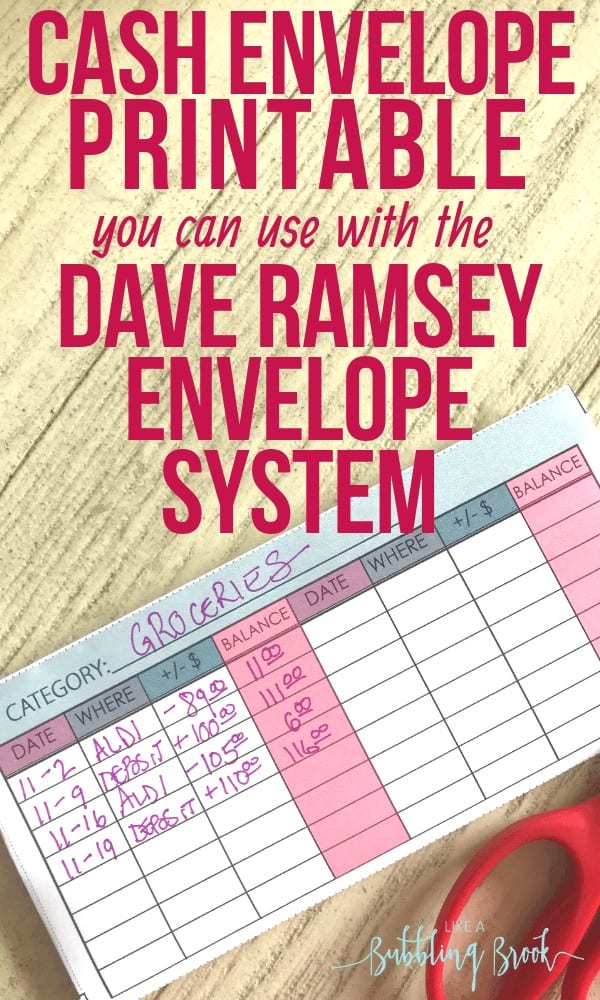

When you get paid, you withdraw the cash for those envelopes from your bank, and then fund the envelopes with their corresponding budget amount.

Then, you carry those envelopes with you everywhere you go. When the money runs out, you have to STOP spending.

Cash Envelope System Wallet Ideas

You can use plain white paper envelopes, fold up some printable envelopes, pull out some plastic sandwich baggies, or if you have a little wiggle room in your budget (or a birthday coming up?!) you can opt for a beautiful, functional cash envelope system wallet. We reviewed several cash envelope system wallet ideas here. Having one makes this whole process a bit more fun!

Grab one of the fun cash envelope designs in our shop:

Finally, I just want to remind you that YOU can do this. There’s a bit of a learning curve in the beginning, but many other families have used a cash envelope system and had success. You can, too. And it will be totally worth it!

If you’d like to read our debt free story, it’s here. And I’d love to hear your story, too! Let me know about it in the comments!

Living debt free was the best decision we ever made. No credit cards, no car payments, no loans of any type!! We even bought a foreclosed home extremely cheaply and were able to pay cash and take a very small percentage out of 401 savings to pay for it. Where there is a will there is a way. Even through cancer and chemotherapy God has kept us and helped our family stay debt free. It took a lot of discipline and truly learning the difference between want and need to get to where we are but the things we have been able to do since we got here have been amazing. Vacations without worrying about bills, my husband being able to take a day off work to simply hang out with our children, living off 1 income so I can homeschool kids, being able to just take a day trip to go on a learning adventure. All these things we could never do when we were caught in the debt trap. It is tough to get out of debt, but the reward of knowing everything you have is 100% yours is simply amazing.