We require hard work from our personal finance apps nowadays, and with so many to choose from, we thought it was time for a Mvelopes review.

We’ve personally used Mvelopes for several years now. If I had to guess, I’d say eight or ten years. Awhile back, they offered users the option to purchase a lifetime membership and we jumped at the opportunity, because we love how this app works.

We’ve tried other apps since then, just to see what we were “missing out” on, but none of them work like Mvelopes. It’s still our favorite after all these years, and now more and more people are agreeing with us. Did you know they were just named the Best Personal Budgeting Service at the 2018 FinTech Awards?

Here’s our Mvelopes review, and the scoop on what you need to know.

Related: Looking for more recommendations? Click here.

Full Mvelopes Review 2018

Our Favorite Feature – It’s Old School, But Better!

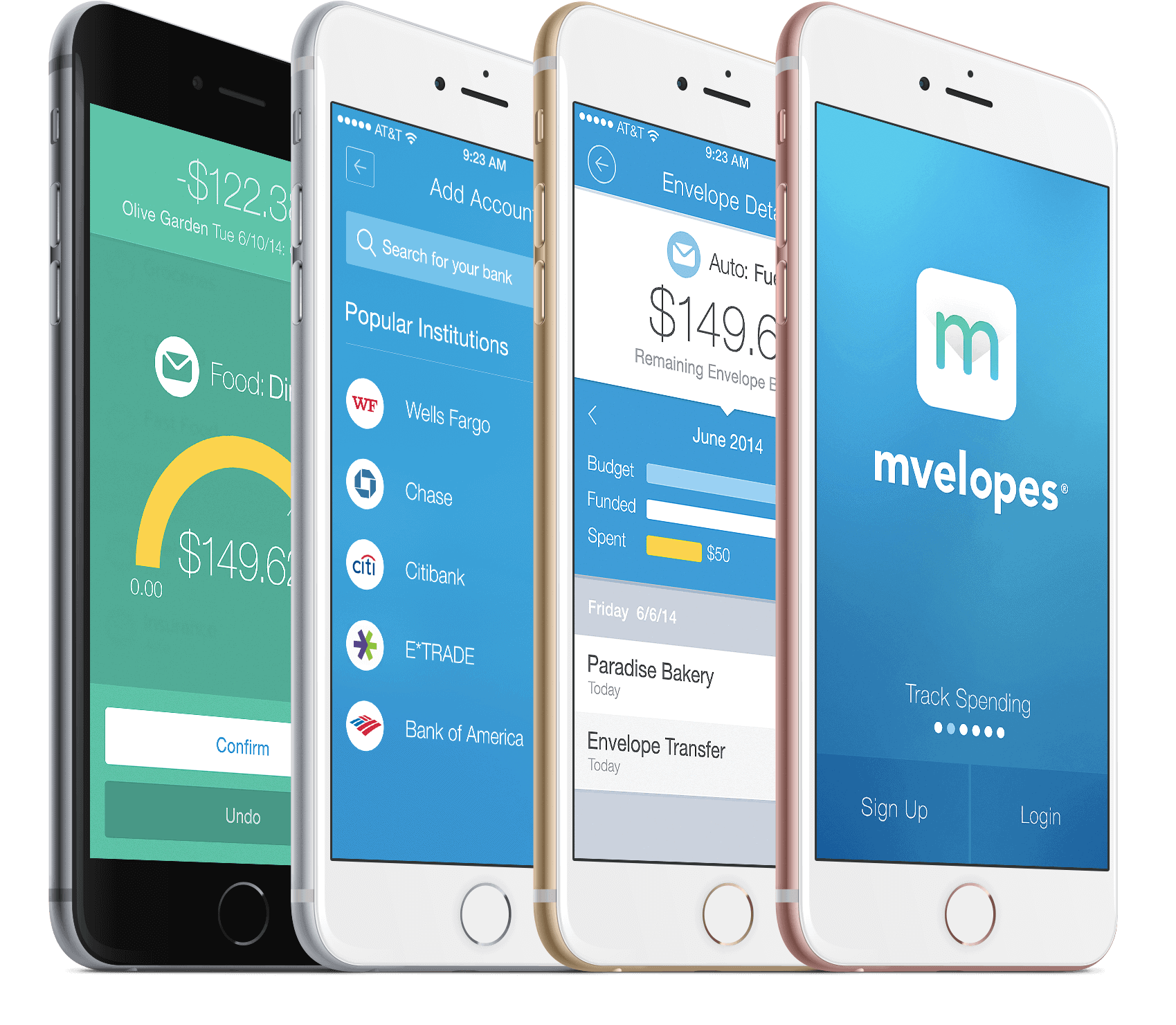

Hands down, our favorite thing about this program is that it’s like the old school envelope budgeting system, except it’s online. There are no paper envelopes to keep track of; instead, you have an app you can use on your iPhone or Android device, or a web site you can log in to from your computer.

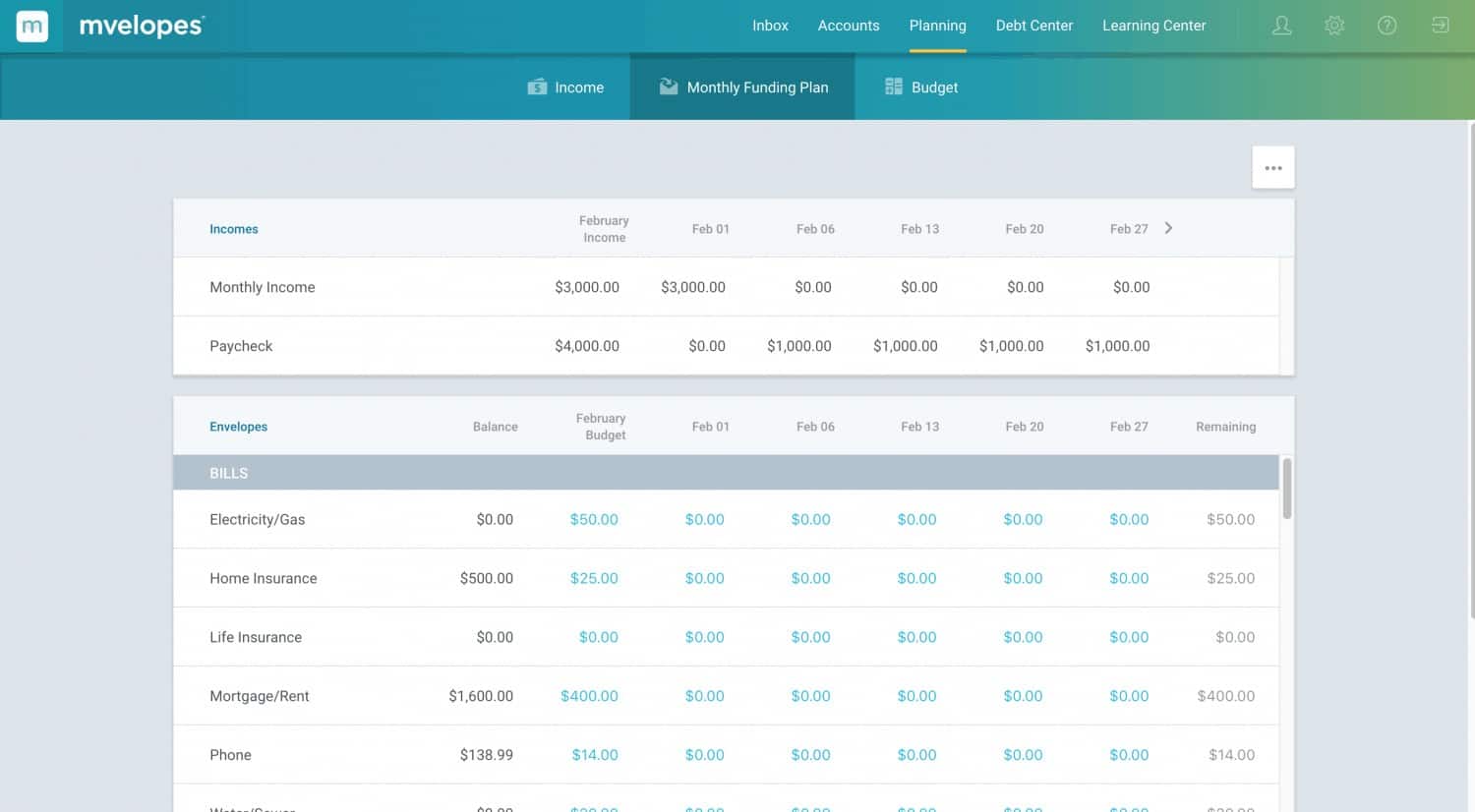

Within the app or web site, you create all the envelopes you would normally, one for groceries, one for gas, one for the mortgage, etc. Once all of your envelopes are set up, you input your income, and define a budget for that income.

For example, let’s say your paycheck is $1,000 (net) a week. You would set up a weekly paycheck profile with that amount, such as:

- Tithe – $125

- Mortgage – $275

- Groceries – $100

- Utilities – $100

- Auto – $100

- Christmas/Gifts – $50

- Vacation – $50

- Miscellaneous – $100

- Savings – $100

Keep in mind this is a simplistic example, but those envelopes would be funded with your paycheck profile. Every time your paycheck hit your account, with just a simple click or two you could fund all of the assigned envelopes each payday.

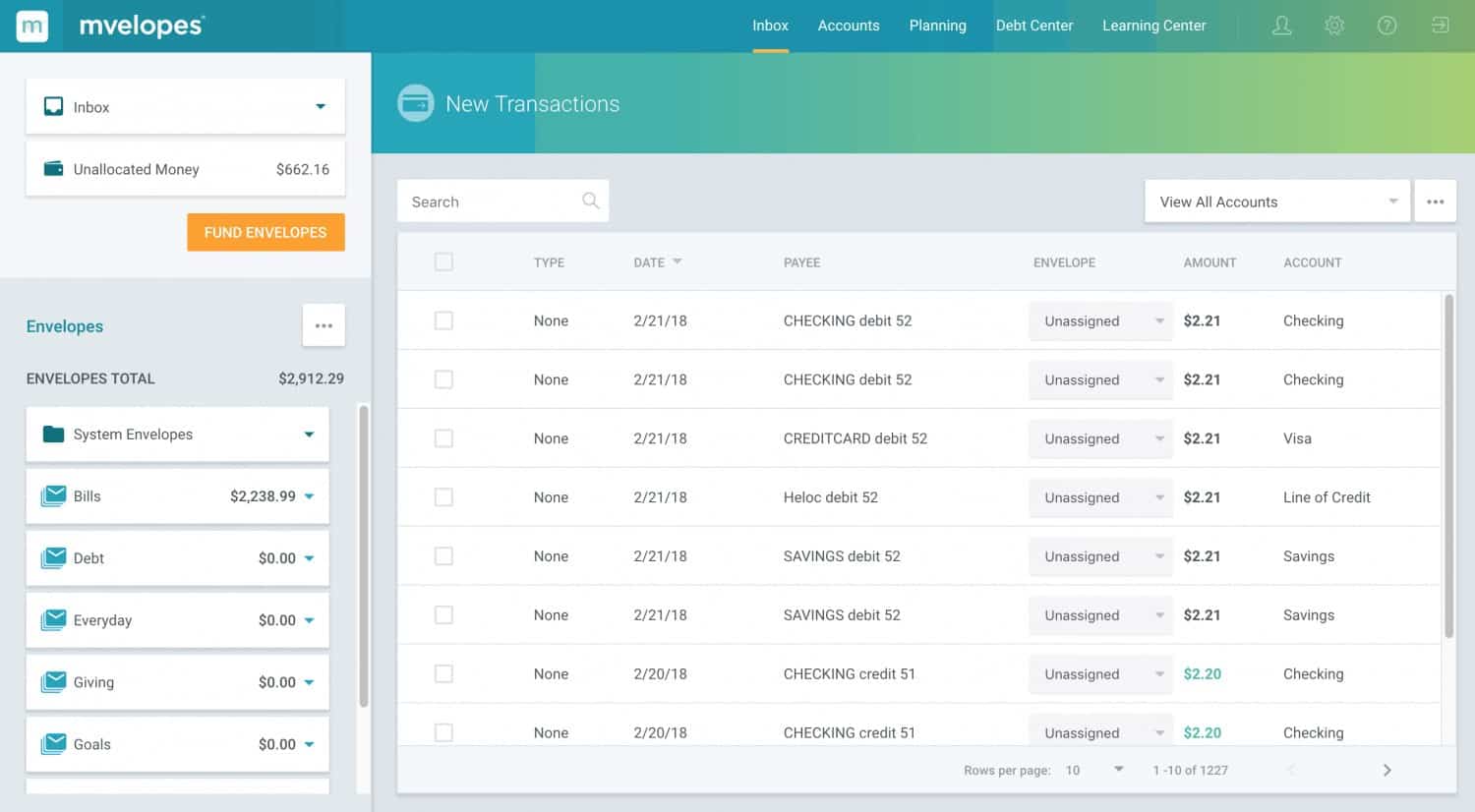

When you pay expenses, and they show up in your online register within Mvelopes, you simply drag them to the corresponding envelope, and that envelope decreases by that amount. What you didn’t spend stays within that envelope and carries over for future use.

photo courtesy of mvelopes

Tracking All Your Accounts

A second feature Mvelopes offers is the ability to add in all of your online banking accounts. For example, we’re able to set it up so that our logins are securely stored and our online accounts updated early every morning. Our app will show us what came through during the night, what our new balances are, etc. We’ve successfully included several types of online accounts into our Mvelopes account, such as our checking, savings, and investments. It will also pull in loan accounts. You get to see all of your accounts and balances at a glance, in one place.

Easy To Modify

You can add/delete/rename your envelopes at any time. You can also adjust your budgeted amounts and income sources at any time. Nothing is set in stone — you have complete control over what’s coming in and what’s going out.

photo courtesy of mvelopes

The Learning Center

If you ever get stuck, they have a link to their Learning Center at the top of their web site, which includes helpful videos for just about every question a beginning budgeter might ask. Currently, there are 10 modules, with anywhere from 6-14 videos per module. They’re both inspirational and educational. Topics covered are Mastering Your Spending, Getting Ahead, Create Wealth & Give Back, and more.

The Coach-Led Budget Makeover

While their basic subscription plan is only $4 a month, they do offer a couple upgrades, one of which is the Budget Makeover. It’s a coach-led, 10-week program that’s like a bootcamp for your budget. If you’re really struggling to get your finances in order, you definitely want to check out the Budget Makeover details and consider signing up.

Compared To Other Programs

Many other programs show you where your money has went historically. Mvelopes helps you plan for where it goes now and moving forward. Once you’ve used it for awhile, you can easily go back and view each envelope’s history, but that’s not it’s intended use. It’s intent is to act as a digital, virtual envelope system, and we all know that an envelope begins with nothing in it. We have to create a budget and fund each envelope, which helps us diligently “tell our dollars where to go” as Dave Ramsey says. Every dollar has a name, every dollar is accounted for.

As you set up your account, you’re mindful of what you’ve been spending in the past. Whether you’re doing Dave Ramsey’s baby steps or not, you may find it’s helpful to read my post What To Do Before You Begin Dave Ramsey’s Baby Steps. Doing what’s outlined in that article will also help you get successfully set up in Mvelopes.

Is Mvelopes For You?

If you’re familiar with or have enjoyed traditional envelope budgeting in the past, then you’ll love Mvelopes. If you need a strict budget and want to be more mindful of where your money is going, you need Mvelopes. If you’re looking for a simple budgeting app to use on the go, you’ll want Mvelopes. If you want to see all of your accounts in one interface, you’ll enjoy Mvelopes.

However, if you’ve tried programs like Mint and like what they offer, Mvelopes might frustrate you. It’s very different than Mint and YNAB.

If you’ve tried some of the other programs and found them to be confusing, we encourage you to give Mvelopes a try. You just might fall in love with numbers again and get your personal finances back on track. We did!

Click here to try Mvelopes (<– this is my affiliate link, where you can try it free for 30 days).

Enjoy!

Leave a Reply